One thing the UK, a huge finance market, has been lacking in recent years is something equivalent to Mint.com. Now Money Dashboard hopes to fulfil at least part of that role. It's a ‘smart' account aggregation service that automatically analyses online banking statements. It's now secured a £2.7 million ($4.4 million) investment round, led by Calculus Capital, a fund which manages private equity funds for individuals. Money Dashboard aims to now develop new services, including launching mobile apps.

In addition, ZAG, a venture-led branding agency under BBH, it to become a shareholder now that it will handle the launch and marketing of the new products.

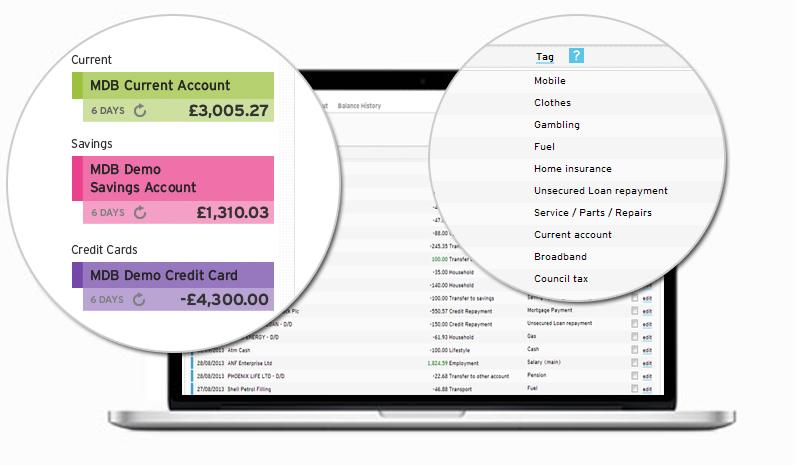

Money Dashboard – going since 2010 – tells UK consumers how much they spend each month on food, leisure and many other categories, for free. It aggregates current, savings and credit cards accounts together in one place, with the same security levels as online banking.

The result are some pretty cool charts showing you spot areas where you could make savings. It also provides spending forecasts and can make consumer aware of their ‘Clear Cash' figure that is available to spend before pay day.

Alerts can also be set, including notifications when balances fall to the point where they risk triggering annoying bank charges. The technology is ‘read-only' therefore no money can be moved or transactions processed through the site.

The business model is generating the majority of revenues by harnessing data to offer ‘switching services' , whereby Money Dashboard gets paid for funnelling users towards energy, broadband, fixed line and satellite TV packages, loans and other services. Not unlike Uswitch.

Susan McDonald, chairman of Calculus Capital, says: "This is a genuinely exciting business with huge potential.” Founder Gavin Littlejohn says: Money Dashboard's rich vein of data and insights will also be further developed.”

via TechCrunch http://feedproxy.google.com/~r/Techcrunch/~3/avwUH8mJx3Y/

0 comments:

Post a Comment