TechCrunch Europe was launched in September 2007, the same week Seedcamp – the European tech startup accelerator – also launched. So we’ve been on something of a journey together. That year and for at least the next 2/3 years after it was largely the only game in town in terms of the new wave of accelerators in Europe. It’s since been joined by TechStars London (formerely Springboard), StartupBootCamp and corporate networks like Wayra to name JUST a few. It seems like Europe is awash with accelerators right now.

But while many of those initiatives are still finding their feet, Seedcamp still draws in many of the top players. Niklas Zennstrom spoke as its first event for instance and is among those superstars who return regularly to Seedcamp events.

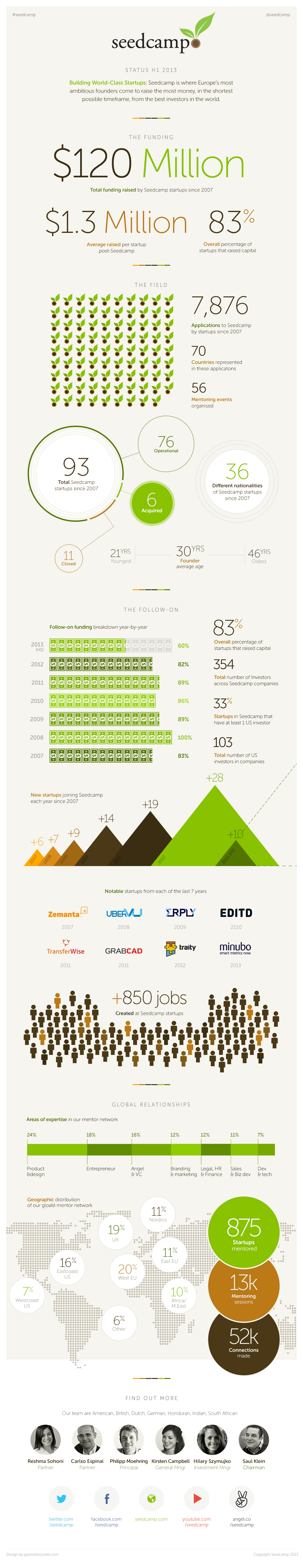

Today – at the opening of Seedcamp Week, when investors flood in to London to take pitches from new Seedcamp companies – it is publishing some data about its 6 year journey exclusively in TechCrunch. The information shows that while Seedcamp may not be the biggest (other are pushing many more companies through their system), the bar to get into Seedcamp remains very high.

There have been 93 Seedcamp companies since it started in 2007. Of those, 76 are still operational, 6 were acquired and 11 closed. Seedcamp Startups have raised $120 million in total since 2007, and $1.3 million is the average follow-on funding raised per startup after it’s been through the Seedcamp process. That’s important to know because the worst kind of accelerator is one where companies whither and die just after the programme. Accelerators need to accelerate.

Here are some more numbers which Seedcamp is releasing:

• In 2007, Seedcamp backed 6 startups. To date, they’ve invested in a total of 93 companies with 10 so far in the first half of 2013.

• They’ve had a total of 7,876 applications over the years, more than 2,000 already in 2013.

• The applications came from 70 different countries, and Seedcamp has backed founders from a total of 36 different countries across the EMEA region in the past six years.

• The nearly 100 startups accepted have gone on to secure $120 million in capital to date, having raised $5.5 million from Seedcamp. That translates into a “22x” in investment terms, and represents an average of $1.3 million in follow-on funding per company.

• Seedcamp companies typically raise in between $330,000 and $2 million in the round immediately following the Seedcamp program. This generally happens within 3-6 months of entry.

• Seedcamp startups have gone on to raise money from 354 investors across Europe, the US, and Asia.

• Some 80% of the 2012 companies (who entered the program at various stages last year) have gone on to raise follow-on funding.

• Out of the companies in the 2013 batch, approximately 60% have already secured follow-on funding.

The companies that closed were: Kublax, Tablefinder, Lookk, tldr, Trebax, Ineze, Efficient Cloud, Publisha and three others that are “in the midst of closing down.”

Of the companies that were acquired, these are: RentMineOnline (acquired by RealPage for $9.5M), Mobclix (acquired by London-based mobile marketing agency Velti for north of $50M), Jeeran (acquired by Talasim), Crashpadder (acquired by Airbnb), Toksta (acquired by Mainseek)and Kukunu (acquired by Rundavoo).

Now, what we can draw from this is that follow-on funding and – ultimately exits – is still no-where near matching the kinds of numbers in the US. The $1.3 million average follow-on makes building significant new company quite hard, especially when your international competitor may have raised 3-5 times that at Series A.

Europe only has 20 percent of the venture capital that’s available in the United States, from about 25 percent as many VCs. Thus, accelerators have a more significant profile in Europe – and they solve one of Europe’s biggest problems, which is clustering startups together so they learn stuff faster.

However, Europe is it’s own game, and frankly you shouldn’t compare everything in the Europe to the US.

Seedcamp’s approach is to trek around the world – mainly Western and Eastern Europe – hoovering up startups at local events and then encouraging them to cluster in a big hub, predominantly London. This is where the biggest investors reside, and the among the most experienced in Europe.

Other accelerators in Europe seem to want to start lots of local divisions based on cities, rather than centralising in one, as Seedcamp does. That means the quality can vary from programme to programme depending on the people involved locally. You will hear that X accelerator is “great in X city but terribly in Y city” for instance.

StartupBootcamp by contrast is going for numbers quite quickly. Launched in 2010, it now has 95 alumni companies, 77 are active (81%), 2 exits so far, and the average is €350,000 raised by each startup, equating to €65million. It has a programme in 7 cities.

Wayra – which started in 2011 in LatAm but is now in various European locations – has about 264 companies (across 14 academies, in 12 countries). Of those, 48% have “graduated”. No Wayra company has been acquired yet and 19 have closed.

All of that aside, Seedcamp is taking not so much a “pile-em high” approach as one which goes after the most high-end investors and investment strategies, and concentrating its fire on one big week a year in London.

It’s an approach which mans their startups raise “sufficient capital within 3 to 6 months” which is comparable to the US, they say.

Speaking to TechCrunch, Reshma Sohoni, said it’s approach is definitely not about lots and lots of companies.

“Our approach has been to bring the best quality and help to our startups, and especially to get them to the next reound of funding/. Our volume reflects that – we do 20-25 investments a year only.

“We go into each location, into 20 cities a year and then bring the startups back to “hubs” that help accelerate them. For us, that is London, Berlin and the US, the East Coast and West Coast.

“We don’t need office space to do that. It’s more about the bridges and the connectionism and where he mentors come from, how many people we can connect a startup with. It’s quite different to the approach of other [city-based] accelerators.”

Speaking about the average raised, she said, this is likely to increase. “We’ve seen the average of $1.4m in from TechStars in the US, for instance. In that sense, we are hitting that that level. I have always said US companies seem to raise twice as much in half the time, and it’s fair point that out. But that’s why we focus so much on 20-25 companies a year and go for follow-on funding. And getting really good investor’s. We’ve sen that with Transferwise, Grabcad, Editd and Erply for instance. If you don’t raise enough as a startup, you can’t hire enough people, so you tend to stay small.”

A third of Seedcamp’s startups have raised money from 103 investors from the United States, including Redpoint, USV, SV Angel, Betaworks, Atlas Ventures, Index Ventures, 500 Startups, Lerer Ventures, Matrix, NextView, Peter Thiel (Valar), Felicis Ventures, IA Ventures, and Horizons Ventures. To be frank, this is a who’s-who of US investors and is part of Seedcamp’s appeal for startup that want early introductions to US investors.

In other words, Seedcamp’s pitch is that you don’t have to start a company in the US to raise from US investors if your accelerator has quite deep US connections.

It’s also partly why the Springboard programme converted into TechStars London last year – that useful connection to the US…

So it’s been a busy 6 years and it will be interesting to see how it all plays out.

via TechCrunch http://feedproxy.google.com/~r/Techcrunch/~3/7Z3Vbtb3hys/

0 comments:

Post a Comment